Bitcoin Stock Investment - Cryptocurrency Investing Vs Trading What S The Difference : While having a stake in the companies that sell bitcoin mining equipment is a potentially smart way to play the bitcoin craze, owning stocks that actually do bitcoin mining is not.

Bitcoin Stock Investment - Cryptocurrency Investing Vs Trading What S The Difference : While having a stake in the companies that sell bitcoin mining equipment is a potentially smart way to play the bitcoin craze, owning stocks that actually do bitcoin mining is not.. This is desirable for traders looking to diversify risk out of their portfolio. Bitcoin is arguably 1 of the most liquid investment assets due to the worldwide establishment of trading platforms, exchanges and online brokerages. There isn't a way to invest in bitcoin the way you would invest in the stock of a company. Furthermore, the company plans to invest in blockchain companies. It is a trust that owns bitcoins it is holding, and by buying shares of it, you can.

Back then, you could buy one of the new digital tokens for less than $0.01. Buying bitcoin is getting easier by the day and the legitimacy of the exchanges and wallets is. There is no etf for bitcoin in the united states, but the grayscale bitcoin trust gbtc 1.84% is the first publicly quoted bitcoin investment option for investors. The company is working to raise funds in order to acquire digital assets through open market purchases. Scott minerd of guggenheim investments — one of the largest asset managers in the world — said his team estimates the price of a single bitcoin could reach us$400,000 (ca$508,000) at some point.

The markets are moving fast.

It is invested entirely and only in bitcoin and has a value that is based only on the price of bitcoin. We plan to hold this. Don't miss out on your chance to profit from the latest rises and falls. As we argued in the 2017 bitcoin return piece, bitcoin is closer to a speculation than an investment. It's no surprise that investors are interested in cryptocurrencies. The third big bitcoin (ccc: While bitcoin may very well continue to be volatile in the short term, we think it has 10x potential from today's levels over the long term as part of a diversified portfolio. Scott minerd of guggenheim investments — one of the largest asset managers in the world — said his team estimates the price of a single bitcoin could reach us$400,000 (ca$508,000) at some point. Furthermore, the company plans to invest in blockchain companies. First, since bitcoins aren't physical. While having a stake in the companies that sell bitcoin mining equipment is a potentially smart way to play the bitcoin craze, owning stocks that actually do bitcoin mining is not. The bitcoin investment trust is the only stock available on the nasdaq or any other us public stock exchange that holds bitcoin as its primary asset. It's easy to replace bitcoin with an alternative, as there are thousands to choose from.

A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. It is invested entirely and only in bitcoin and has a value that is based only on the price of bitcoin. The company is working to raise funds in order to acquire digital assets through open market purchases. While having a stake in the companies that sell bitcoin mining equipment is a potentially smart way to play the bitcoin craze, owning stocks that actually do bitcoin mining is not. We plan to hold this.

Furthermore, the company plans to invest in blockchain companies.

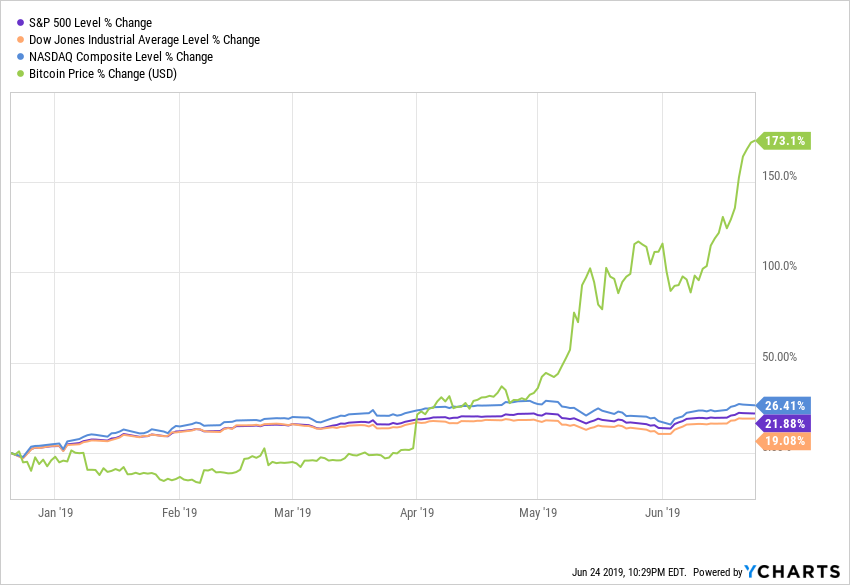

For bitcoins, the time of day any bitcoin was bought or sold makes investor performance vary wildly. While the cryptocurrency is only getting more popular, figuring out how — or even if — it fits into a traditional investment portfolio alongside stocks and bonds isn't easy. Don't miss out on your chance to profit from the latest rises and falls. Bitcoin services inc is a cryptocurrency mining company and developer of blockchain applications. Founded by tech entrepreneur barry silbert in 2013, the grayscale bitcoin trust's investment objective is to track the bitcoin market price on a per share basis in its publicly traded investment. While having a stake in the companies that sell bitcoin mining equipment is a potentially smart way to play the bitcoin craze, owning stocks that actually do bitcoin mining is not. The markets are moving fast. As we argued in the 2017 bitcoin return piece, bitcoin is closer to a speculation than an investment. When investing in bitcoin, one of the biggest dangers is that it could disappear, stein said. Bitcoin was first traded back in 2009. Bitcoin is considered an uncorrelated asset, meaning that there appears to be no link between the performance of the traditional stock and bond markets and that of bitcoin. There is no etf for bitcoin in the united states, but the grayscale bitcoin trust gbtc 1.84% is the first publicly quoted bitcoin investment option for investors. In fact, the company recently added another crypto feature:

It is a trust that owns bitcoins it is holding, and by buying shares of it, you can. When investing in bitcoin, one of the biggest dangers is that it could disappear, stein said. The bitcoin investment trust is the only stock available on the nasdaq or any other us public stock exchange that holds bitcoin as its primary asset. We plan to hold this. Founded by tech entrepreneur barry silbert in 2013, the grayscale bitcoin trust's investment objective is to track the bitcoin market price on a per share basis in its publicly traded investment.

In the third quarter, the cash app generated $1.63 billion in bitcoin revenue, 11 times as much as the third quarter of 2019.

While having a stake in the companies that sell bitcoin mining equipment is a potentially smart way to play the bitcoin craze, owning stocks that actually do bitcoin mining is not. Don't miss out on your chance to profit from the latest rises and falls. Bitcoin is starting the new year with a bang. First, since bitcoins aren't physical. It came just weeks after the firm's billionaire ceo elon musk added a. The markets are moving fast. Furthermore, the company plans to invest in blockchain companies. Bitcoin is considered an uncorrelated asset, meaning that there appears to be no link between the performance of the traditional stock and bond markets and that of bitcoin. While bitcoin may very well continue to be volatile in the short term, we think it has 10x potential from today's levels over the long term as part of a diversified portfolio. It is invested entirely and only in bitcoin and has a value that is based only on the price of bitcoin. Buying bitcoin is getting easier by the day and the legitimacy of the exchanges and wallets is. Back then, you could buy one of the new digital tokens for less than $0.01. That it serves as a helpful hedge in a portfolio because it is not correlated to the performance of stock or bond markets or commodities.

Komentar

Posting Komentar